Table of Contents

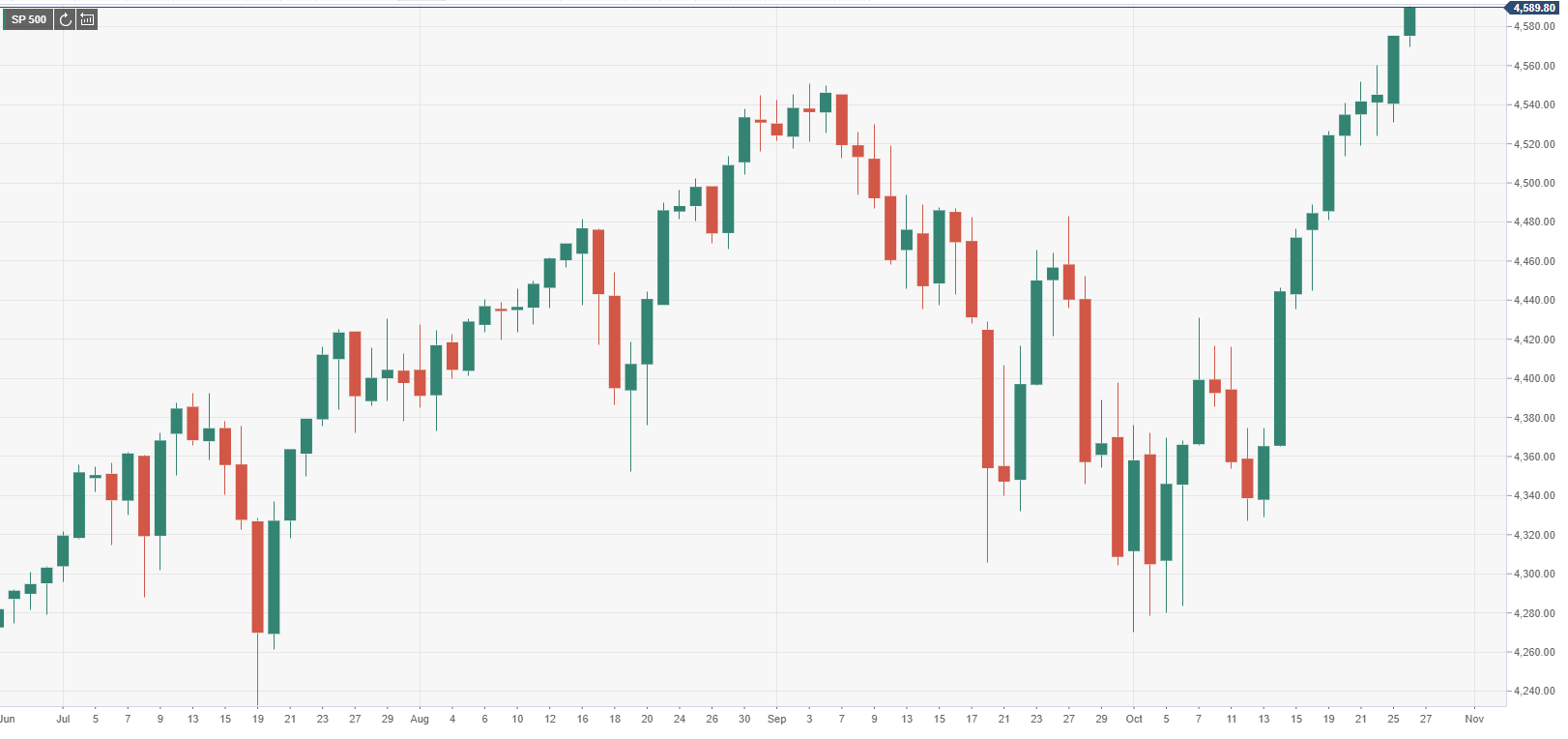

- S&P 500 Index notches new record-high after the opening bell

- S&P Global Office Photos

- 5 Stocks (Not 7) Can Lead To New Highs | Seeking Alpha

- S.P - YouTube

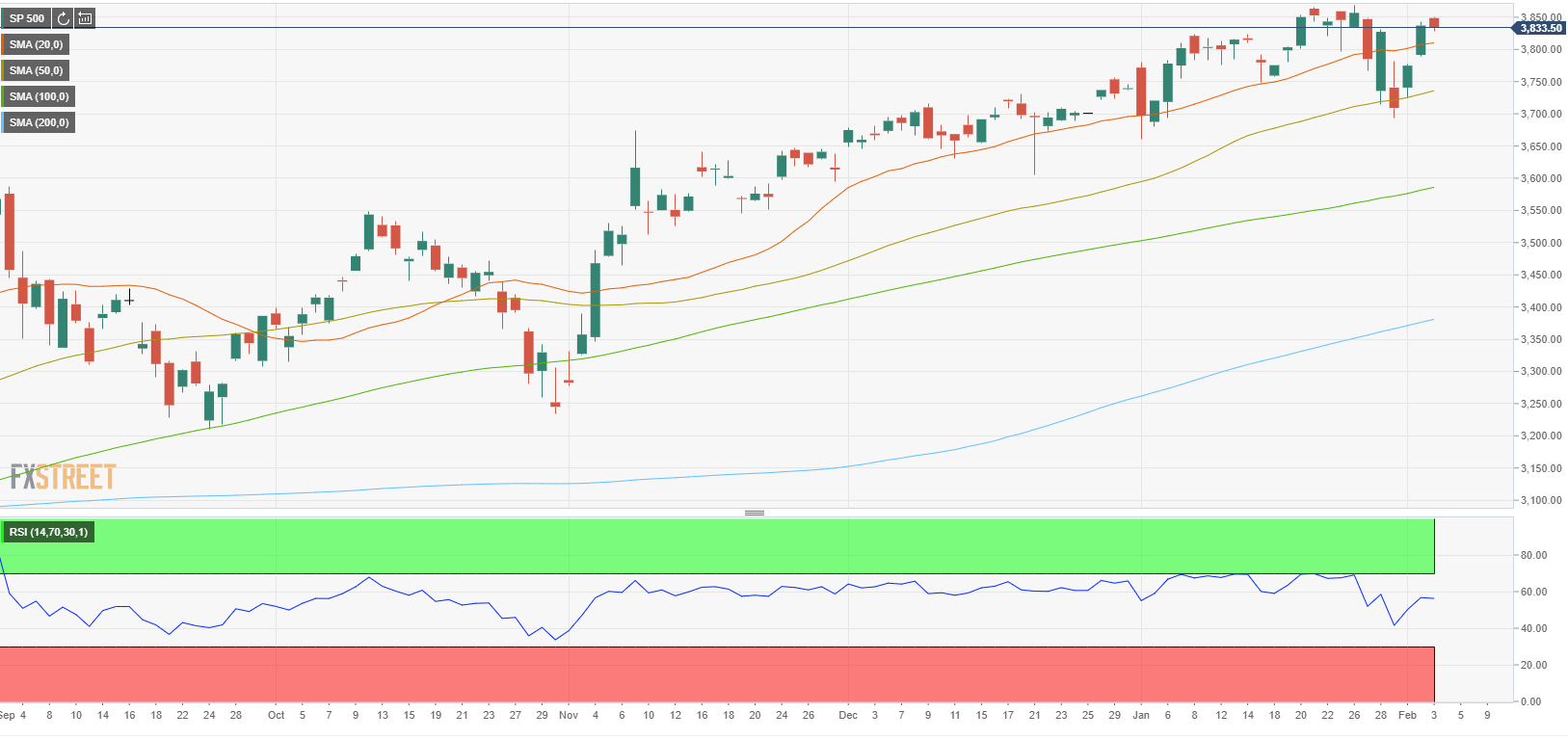

- Indeks S&P 500 Memulai Hari Perdagangan Terakhir Hijau Di Atas 4.200

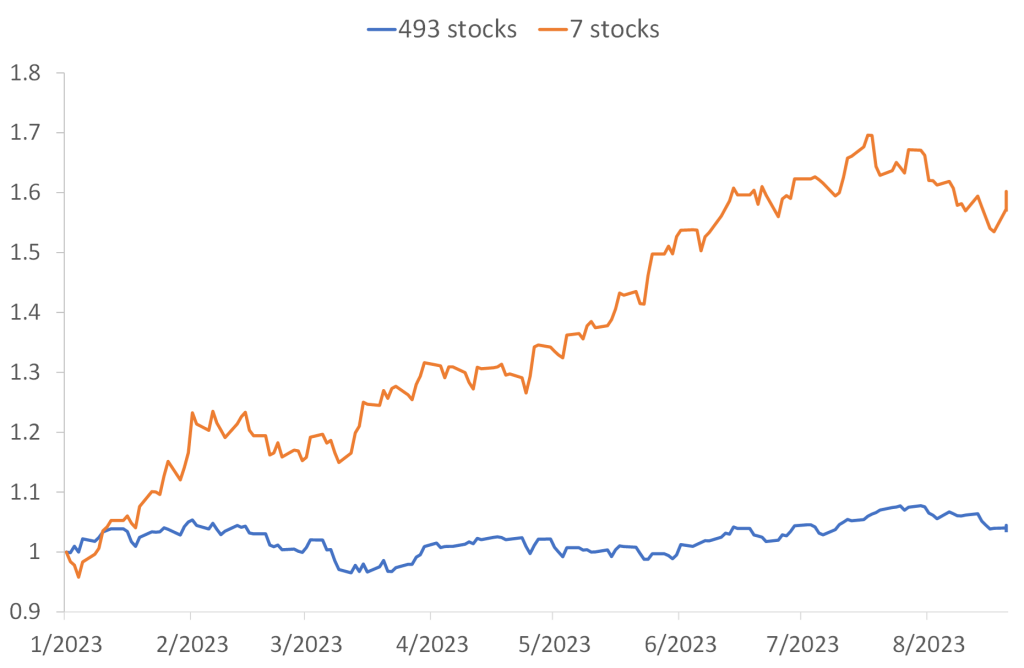

- 7 or 493 stocks: What matters for the S&P 500? – Rangvid’s Blog

- Cairn India's merger with Vedanta "uncertain", says S&P | Latest News ...

- S&P 500 Index opens modestly higher supported by tech shares

- S Block Elements and Their Properties

- 5 Stocks Account For 60% Of The S&P's YTD Return: Charting The S&P 5 vs ...

What is the S&P 500 Index?

How is the S&P 500 Index Calculated?

Why is the S&P 500 Index Important in Investing?

The S&P 500 Index is important in investing for several reasons: Benchmarking: The S&P 500 Index is widely used as a benchmark for the performance of the US stock market. It provides a way to measure the performance of a portfolio or a fund against the overall market. Diversification: The S&P 500 Index includes companies from a wide range of industries, making it a diversified investment option. Low Risk: The S&P 500 Index is considered a low-risk investment option because it is a broad market index that is less volatile than individual stocks. Easy to Invest: The S&P 500 Index can be invested in through a variety of financial products, including index funds, exchange-traded funds (ETFs), and mutual funds.How to Invest in the S&P 500 Index

There are several ways to invest in the S&P 500 Index, including: Index Funds: Index funds are a type of mutual fund that tracks the performance of the S&P 500 Index. Exchange-Traded Funds (ETFs): ETFs are a type of investment fund that trades on a stock exchange like a stock. Individual Stocks: Investors can also invest in the individual stocks that make up the S&P 500 Index. In conclusion, the S&P 500 Index is a powerful tool for investors who want to gain exposure to the US stock market. Its importance in investing lies in its ability to provide a benchmark for the performance of the market, its diversification benefits, and its low risk. By understanding what the S&P 500 Index is and how it works, investors can make informed decisions about their investment portfolios and achieve their long-term financial goals.Keyword: S&P 500 Index, investing, stock market, US economy, benchmark, diversification, low risk, index funds, ETFs, individual stocks.